Can you be blacklisted from opening a bank account?

Your past financial behavior put you on a no-account list. Consumers with a history of unpaid overdraft fees or bounced checks may be blacklisted from opening a new deposit account.

A bank can deny your request to open an account because of past accounts that were closed due to negative balances, a history of overdrafts or problems verifying your identity.

Opening a bank account is easier than applying for a credit card, but consumers should be aware that they can still be denied — likely because of negative actions found on their ChexSystems or Early Warning Services report.

Blacklisting typically occurs when an individual fails to meet their financial obligations, resulting in negative consequences such as being unable to secure loans, credit cards, or even opening a bank account. To check if you are blacklisted, you can receive an annual complimentary credit report.

Second-chance checking accounts allow those who have been denied a traditional account to open a specialized one to help them build a strong financial foundation. Financial institutions offering second-change checking accounts include Capital One, Chime, GO2bank, GTE Financial, Fifth Third, Varo and Wells Fargo.

To be “blacklisted” by ChexSystems effectively means that you have a very poor ChexSystems score. Due to a history of overdrafts, bounced checks, etc., your score is low enough that banks considering you for a standard checking account will likely deny you based on your risk profile.

Common reasons why consumers are turned down for bank accounts include: Past bank accounts that were closed due to negative balances. History of overdrafts, unpaid bank fees or suspected fraud. Errors in your checking account report, such as showing someone else's information.

Pay Off All Outstanding Debts – If the blacklisting results from unpaid debts or fees, resolve them immediately. This can be an important step in repairing your financial reputation. Consider Alternative Banking – Numerous institutions acknowledge that everyone deserves a second chance.

A blocked account generally refers to a financial account that has some limitations or restrictions placed upon it, temporarily or permanently. Accounts may be blocked or limited for a variety of reasons, including internal bank policies, external regulations, or via a court order or legal decision.

Unusual credit activity, such as an increased number of accounts or inquiries. Documents provided for identification appearing altered or forged. Photograph on ID inconsistent with appearance of customer. Information on ID inconsistent with information provided by person opening account.

Can banks see if you owe other banks?

When you apply for a new account, many banks use ChexSystems to see if a previous bank has flagged you for unpaid balances such as overdraft fees. If you are in ChexSystems, it can impact their decision to approve you for an account.

Most banks don't pull a hard credit check to qualify you for a checking account. However, they might look into your ChexSystems report, a banking industry way of peering into an applicant's history. Certain negative items can disqualify you from opening a bank account.

- Step 1: Contact a credit bureau. You can obtain a copy of your credit report from one of the major credit bureaus in South Africa, such as TransUnion, Experian, or Compuscan.

- Step 2: Provide identification. ...

- Step 3: Request a credit report. ...

- Step 4: Review your credit report. ...

- Step 5: Dispute errors.

Once you have been blacklisted you will have a bad credit record for anything from 2 – 10 years, depending on the type of listing that you have against you, but even after this period of time, a judgment can be issued against you if you have not paid the money that you owe.

What happens when you get blacklisted by banks? There is no bank blacklist, but if you have a history of bad checks that will be reflected on your credit report and the banks you wrote them from will have you flagged. You can try a credit union but they check the same credit info.

Don't worry—while it can be more difficult, it is not impossible to get approved for a new bank account with bad credit.

Balance Could Be Turned Over to a Collection Agency

Another important factor to consider when your bank account is closed is that unpaid bank balances could be forwarded to a collection agency.

| Bank / Credit Union | Forbes Advisor Rating | Learn More CTA text |

|---|---|---|

| Capital One 360 Checking Account | 4.5 | |

| Chime® Checking Account | 4.4 | Learn More |

| LendingClub Bank Rewards Checking | 4.2 | Learn More |

| Varo Bank Account | 4.1 | Learn More |

Direct communication: The bank or credit card company may notify the individual about account closures or restrictions due to blacklisting. ChexSystems: Banks use ChexSystems to track fraudulent activity. If someone is listed in ChexSystems, they may be denied bank accounts.

In the case of money laundering, unless given permission by the police, a bank will close your account – often without notice – and is not allowed to tell you why.

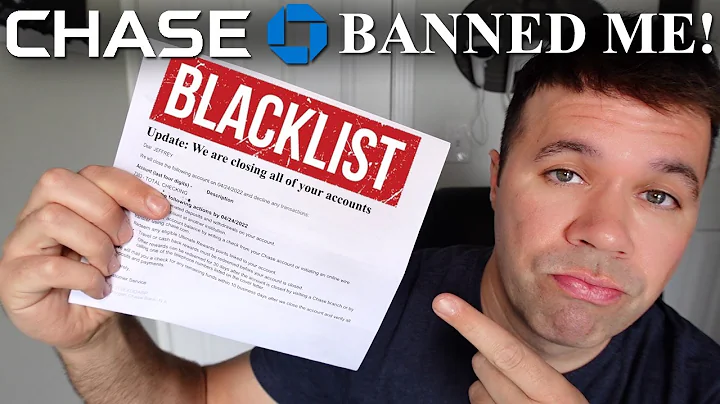

Can Chase bank blacklist you?

“Chase maintains a blacklist of thousands of people who Chase decides it does not want to do business with for any reason or no reason,” according to the complaint.

Many credit unions will open an account for you if you can reasonably explain why you haven't paid a ChexSystems debt, and some credit unions will not pull a report on you even if you do have poor history. Call and ask to speak to the branch manager or other bank official.

How long can a bank freeze your account for suspicious activity? It is most likely to be resolved within a couple of weeks. However, if the NCA are investigating you may not hear anything for up to 42 days. After the expiry of that period the Bank must normally release the bank account unless there is a court order.

Savings Bank account shall not be opened in the name of the following: a. Any trading or business concern, whether such concern is proprietorship, partnership, company or association.

ChexSystems maintains information in your file for five years – unless the agency that reported it requests the removal. This applies even if you've paid all your outstanding balances in full; the accounts can stay on your file unless ChexSystems is required to remove it by law or policy.

References

- https://www.chime.com/blog/how-do-you-clear-your-chexsystems-report/

- https://www.experian.com/blogs/ask-experian/what-to-do-if-bank-closes-your-account/

- https://www.money.co.uk/current-accounts/how-to-rescue-your-finances-if-youve-been-refused-a-bank-account

- https://www.bankrate.com/banking/what-to-do-if-you-cant-open-a-bank-account/

- https://www.quora.com/How-long-can-you-be-in-overdraft-before-a-bank-closes-your-account

- https://wallethub.com/answers/ca/what-credit-score-do-you-need-to-open-a-chase-bank-account-1000414-2140857893/

- https://learn.cypruscu.com/how-to-know-if-you-have-a-chexsystems-record

- https://youverify.co/blog/how-do-banks-verify-identity

- https://www.bankrate.com/banking/savings/online-vs-brick-and-mortar-banks/

- https://mydebthero.co.za/blog/how-to-check-if-you-are-blacklisted/

- https://www.cutimes.com/2005/01/04/navy-fcu-gives-members-with-account-management-problems-second-chance-with-fresh-start-checking/

- https://www.claims.co.uk/knowledge-base/personal-finance/bank-account-rejection

- https://wise.com/us/blog/easiest-bank-account-to-open-online

- https://www.brettwilson.co.uk/services/fraud-and-financial-crime/proceeds-of-crime-act/suspicious-activity-reports/

- https://consumer-rights.org/news/how-do-i-get-a-bank-account-after-being-blacklisted/

- https://www.chexsystems.com/security-freeze/information

- https://www.cnbc.com/select/credit-scores-opening-bank-accounts/

- https://www.lendingtree.com/credit-cards/best/easiest-cards-to-get-approved-for/

- https://www.usnews.com/banking/bank-account-bonuses

- https://gawieleroux.co.za/blog/what-do-when-you-are-blacklisted

- https://www.balancepro.org/resources/articles/chexsystems-the-hidden-key-to-opening-a-checking-account/

- https://www.wikihow.com/Get-a-Checking-Account-if-You%27re-Listed-in-Chexsystems

- https://www.experian.com/blogs/ask-experian/how-to-clean-up-a-chexsystems-report/

- https://www.thebalancemoney.com/help-i-can-t-open-a-checking-account-what-are-my-options-2385797

- https://www.sofi.com/learn/content/how-to-get-a-bank-account-after-being-blacklisted/

- https://www.forbes.com/advisor/banking/best-banks-no-chexsystems/

- https://www.experian.com/blogs/ask-experian/do-you-need-credit-score-to-open-bank-account/

- https://www.chexsystems.com/

- https://www.alogent.com/banking-definitions/suspicious-activity-monitoring

- https://money.slickdeals.net/articles/banks-that-dont-use-chexsystems/

- https://www.consumerfinance.gov/ask-cfpb/when-can-i-be-denied-a-checking-account-based-on-my-past-banking-history-en-1113/

- https://www.quora.com/What-is-blacklisting-in-banking-and-what-can-be-done-to-remove-this-status

- https://www.cnbc.com/select/how-bank-accounts-impact-credit/

- https://www.pnc.com/insights/personal-finance/spend/what-is-second-chance-banking.html

- https://www.rbi.org.in/commonperson/English/Scripts/Notification.aspx?Id=3213

- https://www.cusocal.org/blog/chexsystem-denied-checking-account

- https://www.quora.com/Why-do-most-banks-decide-to-blacklist-the-customers-to-open-new-bank-accounts-and-get-new-bank-cards-for-years

- https://www.forbes.com/advisor/banking/cannot-open-bank-account/

- https://www.quora.com/How-can-you-determine-if-someone-has-been-blacklisted-by-a-bank-or-credit-card-company-Will-it-appear-on-a-credit-check

- https://www.thetimes.co.uk/money-mentor/current-accounts/can-bank-close-my-account-without-consent

- https://hahnlaw.co.za/services/credit-bureau-clearance

- https://www.nerdwallet.com/article/banking/blocked-by-chexsystems-what-to-know

- https://www.usnews.com/banking/articles/options-for-second-chance-checking-accounts

- https://www.moneylion.com/learn/can-bank-tellers-see-your-balance/

- https://www.sofi.com/learn/content/do-banks-run-credit-checks-for-checking-accounts/

- https://www.firstunitedbank.com/instant-issue-debit-card

- https://www.cusocal.org/blog/chexsystems-removal

- https://playmoneysmart.fdic.gov/tools/126

- https://www.wikihow.com/See-if-You-Are-on-ChexSystems-List

- https://www.consumerfinance.gov/ask-cfpb/can-a-bank-or-credit-union-refuse-to-open-a-checking-account-for-me-en-949/

- https://www.td.com/us/en/small-business/debit-card

- https://karnatakabank.com/personal/savings-account/kbl-xpress-sb-account

- https://www.prnewswire.com/news-releases/no-card-no-problem-pnc-customers-get-debit-cards-instantly-at-most-branches-300287553.html

- https://consumer-rights.org/news/what-is-the-easiest-bank-to-open-online-in-the-uk/

- https://www.chexsystems.com/optout

- https://www.moneysavingexpert.com/banking/basic-bank-accounts/

- https://www.wafdbank.com/blog/banking-101/why-cant-open-bank-account-what-to-do

- https://www.bankrate.com/banking/checking/bank-denied-you-for-a-checking-account/

- https://www.mentalhealthandmoneyadvice.org/en/managing-money/what-are-my-options-for-dealing-with-debt/will-i-be-blacklisted/

- https://www.opploans.com/oppu/credit-repair/found-yourself-on-the-chexsystems-blacklist-heres-what-you-can-do/

- https://www.nidirect.gov.uk/articles/overdrafts-and-other-bank-debts

- https://www.bankrate.com/banking/how-to-clear-up-chexsystems-report/

- https://www.nerdwallet.com/article/banking/how-to-open-a-bank-account-what-you-need

- https://www.varomoney.com/money-101/banking/how-to-open-a-bank-account-with-no-deposit/

- https://wallethub.com/answers/ca/what-credit-score-do-you-need-to-open-a-bank-of-america-bank-account-1000414-2140857890/

- https://www.chase.com/personal/credit-cards/education/build-credit/opening-a-bank-account-with-bad-credit

- https://financebuzz.com/easiest-bank-accounts-to-open-online

- https://www.investopedia.com/terms/b/blocked-account.asp

- https://wallethub.com/edu/cs/chexsystems-score/13318

- https://www.nerdwallet.com/article/banking/what-to-do-when-you-cant-open-a-bank-account

- https://www.investopedia.com/ask/answers/040715/what-should-you-bring-bank-open-checking-account.asp

- https://www.bankinfosecurity.com/26-red-flags-a-932

- https://www.capitalone.com/bank/money-management/banking-basics/opening-a-bank-account-online/

- https://www.experian.com/blogs/ask-experian/why-was-i-denied-a-checking-account/

- https://www.iob.in/upload/CEDocuments/Savings_Bank_Rules.pdf

- https://www.helpwithmybank.gov/help-topics/debt-credit-scores/credit-scores-reports/credit-reports/credit-report-chex.html

- https://fortune.com/recommends/banking/best-checking-account-bonuses/

- https://www.forbes.com/advisor/banking/easy-bank-accounts-to-open/

- https://smartasset.com/checking-account/chexsystems

- https://www.forbes.com/advisor/banking/best-bank-accounts-for-bad-credit/

- https://www.law.com/dailybusinessreview/2023/11/17/broward-suit-seeks-600m-payout-from-chase-bank-for-alleged-blacklisting/

- https://www.debtstoppers.com/blog/10-bank-accounts-you-can-open-even-if-you-have-bad-credit/

- https://www.bankofamerica.com/deposits/debit-card-faqs/

- https://www.cnbc.com/select/best-second-chance-checking-accounts/

- https://www.cnbc.com/select/what-to-do-if-denied-bank-account/

- https://www.opploans.com/oppu/banking/bad-credit-opening-a-bank-account/

- https://www.cnet.com/personal-finance/banking/advice/best-banks-for-customer-experience/